The COVID-19 pandemic has brought waves of disruption to almost every aspect of our “normal” lives – an invisible and highly contagious enemy, forcing closures of almost every pillar of our daily lives: offices, schools, places of worship, bars, restaurants, stores, gyms and anything deemed “non-essential.”

Despite this disruption, we have found new ways to connect virtually, trying to “flatten the curve” by moving much of our daily lives to a physically disconnected, but vastly more digitally connected new reality. As technology adoption had already made great strides before the pandemic in replacing many activities traditionally completed in-person, mandated social-distancing has created many new converts.

One aspect of this “new normal” is fulfilling the basic need of a weekly trip to a supermarket or grocery store.

Grocery eCommerce is not a novel concept — retailers like Peapod and Fresh Direct have been operating for many years, while retail giants Target and Walmart have heavily invested into their eComm infrastructure in recent years. Upstarts Instacart, Shipt and Amazon Fresh are also creating waves of disruption with the rise of the gig economy. Online grocery was already predicted to be the fastest-growing eCommerce category at 18.2% to $19.89 billion in 2019, and today’s current pandemic just pushed that growth curve to light speed.

Exponentially Increased Demand in Grocery eCommerce: Pandemic Highlights By the Numbers

As demand surges with coveted inventory selling out and long lines at the store, many consumers looking to avoid the risk of physical in-person shopping have turned to online grocery ordering to stock up on quarantine essentials, including a large percentage of first-time eCommerce Shoppers.

- Quotient retail partner Ahold-Delhaize is seeing a larger percentage of customers over 60 coming online, and of the one-third of surveyed consumers that purchased groceries for online pickup or delivery in the past 7 days, 41% said that they were buying them online for the first time.

- These first-time eCommerce shoppers have been growing since end of Feb and have reached 3x beyond usual levels.

- In March, 31% of U.S. households (about 39.5 M consumers) have used an online grocery delivery or pickup service during the past month compared to 13% (16.1 M consumers) in August of 2019.

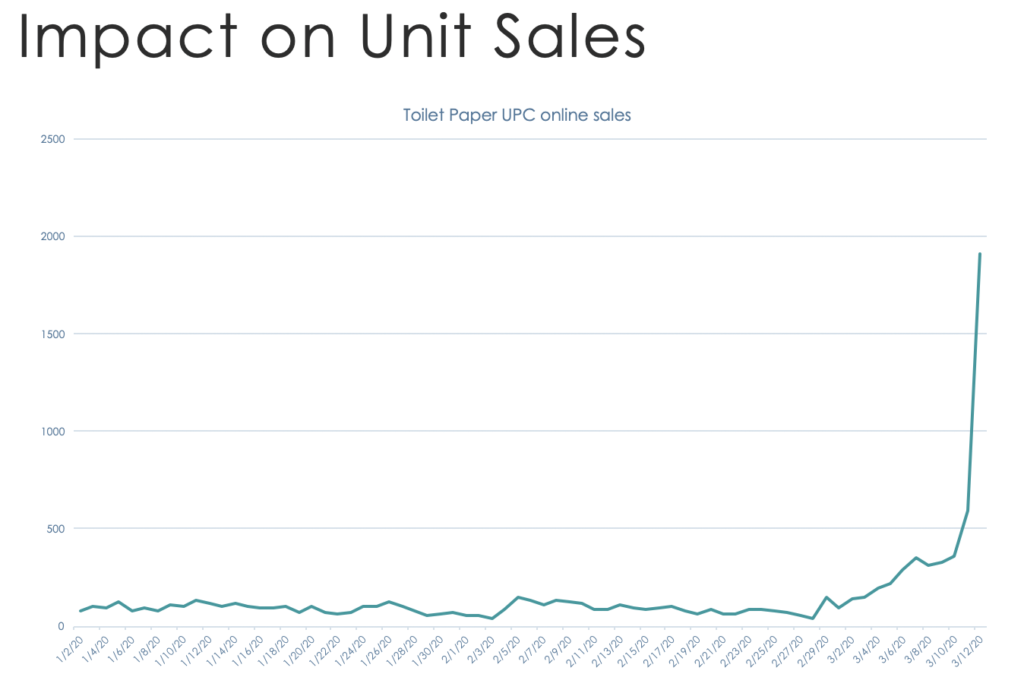

- This increased demand (and subsequent sales lift), has unsurprisingly spotlighted a number of consistently in-demand product categories, most of which center around health and personal care, household goods, and shelf-stable pantry staples.

Source: Quotient Internal Reporting, March 2020

Key Stat: Consumers are searching key terms 3X more, spending 15x more in top categories

Source: Quotient Internal Reporting, March 2020, Top categories include Disinfectant, Tuna, Cleaner, Pasta Sauce, Hand Sanitizer, Soap, Soup

The New Normal: Winners and Losers

- Those who have modernized their operations with fully functional eCommerce programs already in place are at a huge advantage. They are able to meet the huge demand for online grocery orders – these orders have surged 233% from $1.2 B in 2019 to $4.0 B in 2020, with the average spend per order up 14% (from $72 in 2019 to $82 in 2020) and the total orders placed in the last 30 days jumped 192% (from 16.1 in 2019 to 46.9 M in 2020). (Source: Brick Meets Click)

- Brands investing in sponsored search will be able to stay top-of-mind during consumers’ online shopping – getting into the baskets of new online shoppers also drives repeat purchasing as they select ‘buy again’ in the future. Quotient eCommerce reports 4x incremental traffic in March 2020 alone.

- Smaller and mid-sized retail chains are at a disadvantage as they don’t have the capital to invest in building out delivery infrastructure. (Source: CNN)

- Gig-economy based delivery services Instacart and Amazon are now facing worker strikes and increasing pressure to meet demands for hazard pay, adequate paid sick leave and protective health and safety supplies. The continued success of their business will depend on how they choose to handle the demands of their contractor labor force.

What Do These Trends Mean for CPG Marketers?

- Food Delivery – Online shopping and home delivery will increase as consumers avoid going to areas where there are large gatherings.

- Out-of-Stocks – Manufacturers will focus on production of top SKUs to meet demand; expect fewer options but satisfactory supply levels of most in-demand products

- Private Label – Private labels are a threat during this time, where loyalty is low, and access to products is most important

- Media Channels – Campaigns need to evolve to focus on channels that leverage the change in behavior

- Messaging – Messaging needs to support individuals today and deliver value to consumers in this time of need.

What Other Challenges Have Surfaced for Online Grocery in this New Landscape?

- With the exponential rise in demand, it has quickly become a challenge for consumers to place orders – system interfaces and delivery availability have become unpredictable and unreliable.

- This limitation in delivery availability causes a jam in the queue as customers order for next week since the current week’s delivery days are already sold out.

- Another circumstantial issue that has popped up for online grocery delivery is in their fundamental design: matching supply (available “shoppers” and delivery drivers) with demand. The strain on resources for this exponential level of consumer demand has many services struggling to feed this high volume and lucrative revenue stream.

Potential Long–Term Effects on the Grocery eComm Landscape

The big question remains — will there be retention in the increased adoption of online grocery ordering?

Obviously we’re in completely uncharted territory, on an unknown timeline, so it’s difficult to predict future outcomes, but with the rapid rate of adoption – we’d optimistically say yes, consumers will recognize the convenience and develop a level of comfort and familiarity after life returns back to normal. According to a recent Brick Meets Click/ShopperKit Online Grocery Shopping Survey, 43% of the survey respondents indicated that they’re either extremely or very likely to continue using a specific online grocery service after the pandemic restrictions conclude.

Quotient’s multi-layered eCommerce solution can help your brand provide value to shoppers during this difficult time. For further insights, reach out to your Quotient representative or contact Harrison Sebring, Quotient’s Commercial Lead – Brand & Retailer Partnerships, eCommerce Vertical at HSebring@Quotient.com.

Be sure to keep an eye on Quotient’s news feeds with the latest information and resources to help your brand weather the ongoing COVID-19 pandemic and check out our other related posts:

- Socializing while “Social Distancing”: How Your Brand Can Thoughtfully Connect with Shoppers During COVID-19

- Industry News Roundup: How Coronavirus is Affecting the Influencer Marketing Business

—

Ken Platt is a seasoned omni-channel expert, successfully navigating the constantly changing industry over the past 20 years. As the Managing Director of Quotient eCommerce, Ken is passionate about omni-channel retail and delivering impactful, measurable results for his Retailer and CPG partners. Ken’s background spans eCommerce solution delivery across multiple platforms, technologies and industries — providing him a unique perspective into the sector and clear advantage in the delivery of quality at pace and scale over the competition.