Survey Reveals New Trends About Pandemic Pet Parents

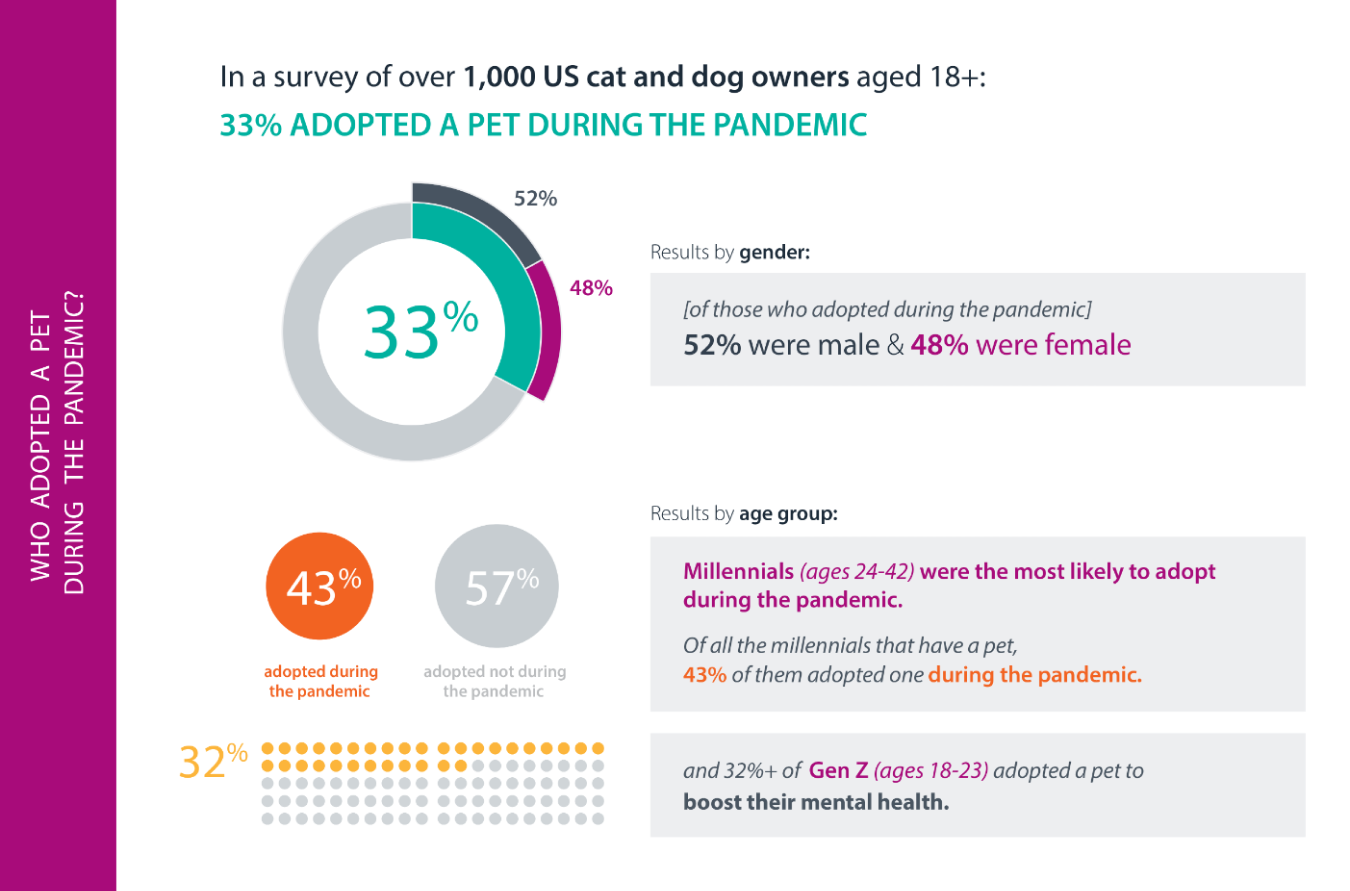

As social distancing pushed people to spend more time at home during the pandemic, it’s no surprise that many consumers took the opportunity to welcome a new pet into their household. For advertisers and retailers, that means the opportunity to reach and offer value to these category buyers will stretch on for years to come. We conducted a survey of over 1,000 US cat and dog owners to understand how people are shopping for their new furry family members and what marketers can do to reach them.

Download the full report here, and keep reading below to uncover the highlights.

32% of Gen Z adopted a pet to boost their mental health

Over one-third of survey respondents (33%) noted that they adopted a pet during the pandemic. To supplement this data, we analyzed our internal social and sales data to reveal how consumers’ shopping habits for pet items changed during the pandemic.

We found that as people settled in to working from home with their pets, dog control products—such as bark control, harnesses and gentle leads—saw a 113% increase in sales compared to pre-pandemic. The survey shows that of the people who adopted pets during the pandemic, 52% were male and 48% were female.

Furthermore, the survey revealed that millennials (aged 24-42) adopted pets during the pandemic in the highest proportion, with 43% contributing to the “fur baby boom.” While 40% of millennials said they adopted pets for children and other family members who had been wanting one, 32% of Gen Z (aged 18-23) adopted a pet to boost their mental health.

“With the adoption of furry companions during the pandemic, we found interesting consumer purchase trends for food, gifts, treats and more. These animals have already and will continue to influence consumers’ purchasing behavior long after the pandemic is over. This provides retailers and brands with the opportunity to identify and provide value for the ongoing needs of their customers—and their pets.”

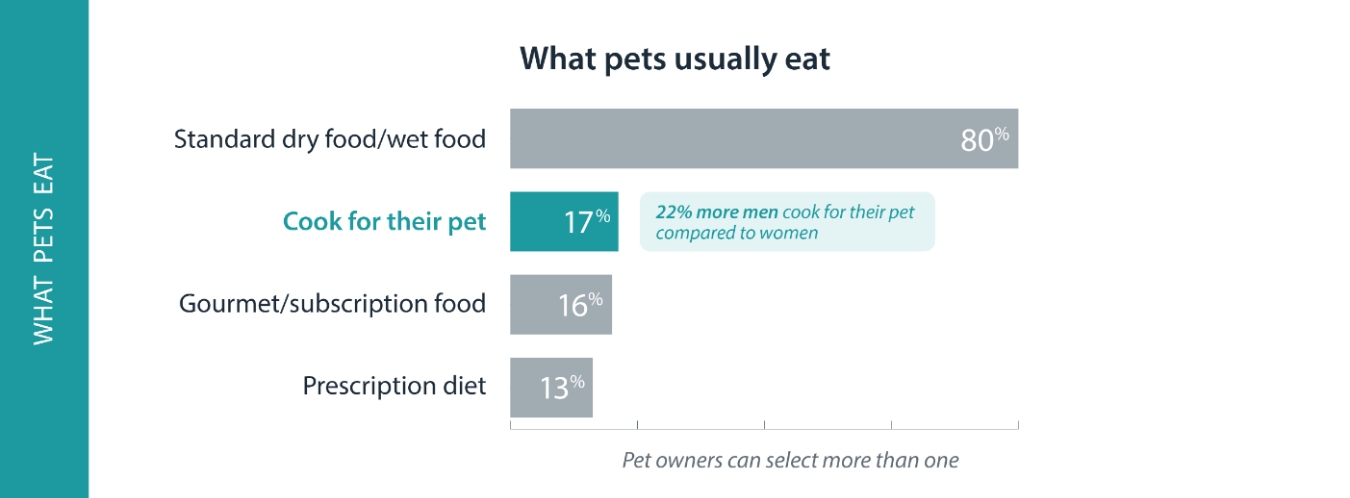

Almost 17% of Respondents Cook for Their Pet

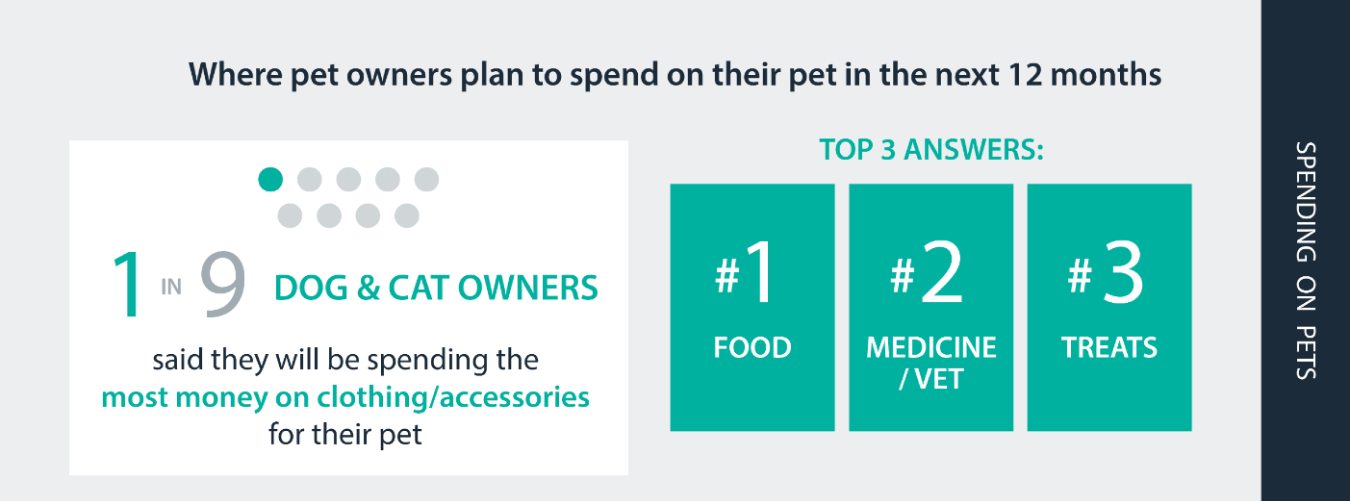

As pandemic restrictions eased across the US, we asked dog and cat owners which pet items they plan to spend the most money on over the next 12 months (respondents could pick multiple options). Food (84%) and medicine/veterinary care (45%) emerged as the biggest expenses. Forty-four percent of dog and cat owners are also planning to pamper their pooches and kitties by purchasing treats. And while standard dry and wet food reigns supreme as the pet food most commonly eaten (80%), almost 17% of respondents noted that they cook for their pet. Of those who cook custom meals for their pet, male respondents led the way at 55% compared to 45% of female respondents.

Respondents are willing to pay a premium for their pet’s food, too. Just under one-sixth (16%) of respondents usually feed their dogs and cats with gourmet or subscription food services. Younger generations have a higher proportion of respondents who feed their pets with premium selections (21% of both millennials and Gen Z). This supports Quotient’s internal data that also shows pets are eating premium. Non-dry dog food sales—including wet and moist dog foods, which tend to be more expensive—are up 25% compared to pre-COVID.

Pet Owners Plan to Spend $87 On “Gotcha Day”

While most pet owners anticipate that necessities like food and healthcare will dominate their expenses, the survey shows that 11% expect clothing and accessories to rack up the highest bill over the next 12 months. This is not surprising given that 78% of respondents consider their pet to be their best friend or family member. Their love and affection continues throughout the various seasons of gift giving, with almost half (42%) of respondents planning to pamper their pooches with a Christmas surprise. Nearly as many plan to pick up a birthday gift (40%). “Gotcha Day” (anniversary of adoption) is another important milestone, and respondents who will celebrate it plan to spend an average of $87 on a gift to commemorate the occasion. This is notably higher than the amount of money consumers plan to spend on holiday gifts ($57), Halloween costumes ($59) or birthday gifts ($62).

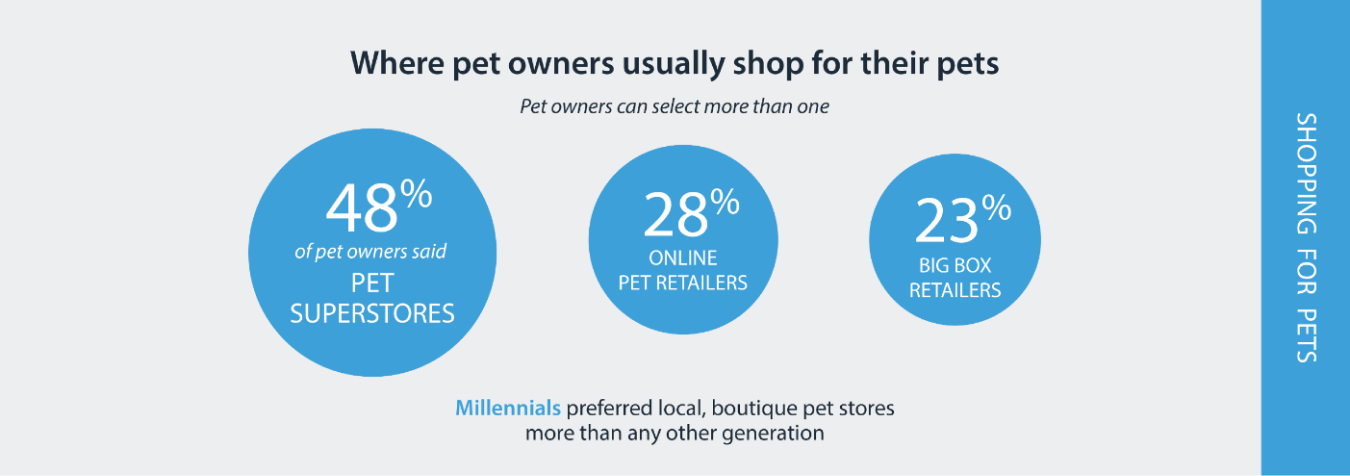

39% of Baby Boomers Shop at Pet Superstores

When asked what stores they shop at for their dog or cat, pet superstores received the greatest number of responses (48%). Of baby boomers (aged 55-73), 39% shop at pet superstores, but they also enjoy the shopping experience that big box retailers provide (31%). Millennials preferred local, boutique pet stores (24%) at a higher proportion than any other generation.

With the increase in dog and cat adoptions during the pandemic, consumers’ shopping habits are likely to continue evolving for the foreseeable future. And unlike other COVID-inspired booms where consumption levels will likely level out, consumers who adopted a pet during the pandemic will need to continue purchasing food, toys and medicine over the lifetime of their new furry friend. This presents advertisers and retailers with the unique opportunity to identify and serve their customers’ new shopping needs for years to come.

For more information on how Quotient can help you reach these new pet parents (and their four-legged friends), contact us at communications@quotient.com.

Methodology Statement: The research was conducted by Censuswide with 1,017 dog and/or cat owners in the US aged 18+ from 06/07/21 – 06/09/21. Censuswide abides by and employs members of the Market Research Society, which is based on the ESOMAR principles.

Source: Quotient Internal Data (1/1/21 – 4/30/21 vs. 1/1/20 – 2/16/20)